Toast: Valuation

A few weeks ago, I covered CAVA. For no reason in particular, I’ve decided to stick with the restaurant theme and cover one of the “up and coming” service providers - Toast ( TOST 0.00%↑ ). Toast is hardly a new player in the space. They’ve been around since 2011, but have been winning market share and have started gaining real business momentum as of late...even while their stock price has floundered.

To explore more companies that I’ve covered, check out the full Corporate Valuation Catalog

Executive Summary

If all you do is read the Business Overview & Revenue Drivers overview, you’ll have a pretty good understanding of what Toast does and how they make money.

My overall findings are that Toast is probably about fairly valued today (at $30 per share) using modest, but optimistic growth assumptions. However, the investment comes with additional potential upside if management succeeds in their expansion efforts.

You should also check out the Risks section at the very bottom of the article because I highlight some interesting quirks about Toast’s business model and risks associated with the overall segment of the market they operate in.

Business Overview

Toast Inc. provides a cloud-based "operating system" built specifically to handle the unique, fast-paced demands of the restaurant industry. By unifying point-of-sale, back-office operations, and guest experience into a single platform, they eliminate the need for fragmented, disconnected tools.

Toast has historically targeted small to medium (SMB) restaurants, but has recently expanded their customer base to include larger enterprises like Applebee’s and TopGolf among others.

Today, Toast powers over 150,000 locations, and has been actively capturing market share.

Revenue Drivers

The first step is to understand how Toast makes money. Toast’s revenue is split into 3 categories:

I’ll cover these in more detail further down, but just to give a broad lay of the land:

Subscription Services start with the basic monthly rate that Toast charges for using their system - this fee is generally less than $100 per month (per location). In addition, there are add-on features like takeout, marketing & loyalty rewards programs, inventory management, hardware subscriptions (i.e., handhelds) and other “back of house” functions like payroll management applications.

Financial Technology Solutions (FTS) are split into two sub-categories. The first is payment processing. Every time someone makes a purchase and swipes their credit card, Toast collects a fee. A portion of this fee is divvied to the credit card company for transaction costs, while Toast keeps a slice for themselves. In addition, FTS also includes Toast Capital. Toast Capital is a program that lends money to restaurants. To-date, revenue generated by Toast Capital is a relatively small proportion of the total FTS pie.

Hardware & Professional Services (HPS) is primarily driven by the equipment and support needed to setup a new restaurant on the Toast network. This is generally considered a one-time transaction.

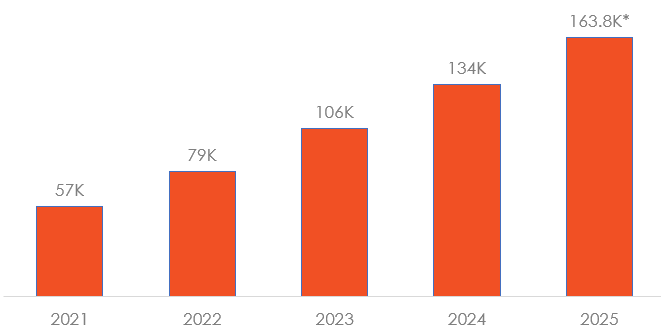

User Growth

Toast is expanding their user base. As of Q3 of 2025, they surpassed 150k locations.

Their primary focus has historically been small to medium sized restaurants. As of 2024, Toast has begun signing on larger & higher profile customers.

In addition, Toast has ambitions of expanding into other verticals: Food & Beverage Retail, Hospitality, and Grocery being the big ones.

Subscription Services

Subscription revenue is derived from the base plan along with any add-on features that a restaurant owner might want:

This is the most straight forward category to break down. It’s recurring revenue that should scale relatively well with the number of locations.

Note that all 2025 numbers are estimates based on year over year growth as of the third quarter. Dollar amounts are all annual.

In general, we see subscription revenue climbing in compounding fashion - Toast is signing more customers, and customers are paying more on average (ARPU). ARPU (Average Revenue Per User) has been increasing due to price adjustments as well as upselling existing customers into more advanced features.

One driver that I think may see ARPU level off a bit (or maybe even decrease) is that as Toast brings on more enterprise level customers, those customers may be able to command better pricing from Toast.

Financial Technology Solutions (FTS)

Financial Technology Solutions is split into two sub-categories: Payment Processing & Toast Capital.

Payment Processing

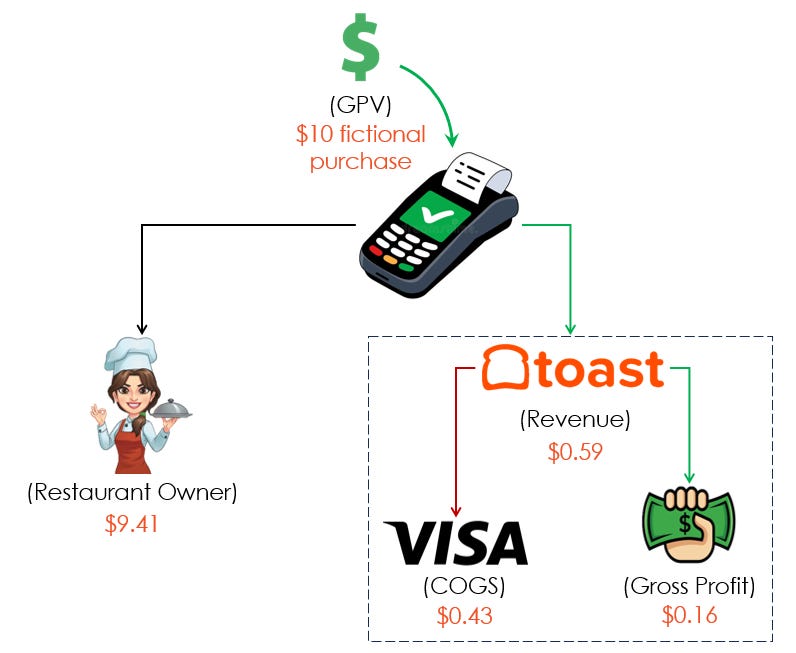

Figure 4 shows how the typical transaction might look when an end consumer buys a burrito or cup of coffee through a Toast Terminal.

The restaurant owner collects the bulk of the transaction. Toast collects some percentage as a transaction fee - this fee differs based on the transaction type and the plan the restaurant owner has, but it’s typically something like 2.9% + 30¢ per transaction.

So if someone purchases a $10 burrito, something like $9.41 goes to the restaurant and 59¢ will go thru Toast (recorded as revenue). Of that 59¢, 43¢ will go to the credit card company (recorded as cost of revenue) and 16¢ will go to Toast to keep (gross profit). Note, the ratio split may not be consistent over time and will vary between customers.

Toast reports GPV (Gross Payment Volume) at the top level - this reflects all the money passing through their systems. Then they break down cost of goods (COGS) and gross profit. The percentage of gross profit to GPV is referred to as their “take rate”. In general, if Toast’s take rate remains a steady percentage of GPV, their gross profits should trend with consumer spending.

Toast Capital

If you want to be confused, try tracking down the structure of Toast Capital’s operations1 in the filings...

Toast Capital is structured as a standalone subsidiary, wholly owned by Toast, Inc.

The gist is that restaurants can borrow, on a short-term basis, between $5k to $300k. These loans are typically termed between 90 days and a full year.

Toast Capital markets, underwrites, and services the loans. The loan is originated and held by a 3rd party bank.

Toast then collects daily fees as part of the payback agreement. They pay the bank interest and principal while cutting off a small portion for themselves for servicing the loan.

But that’s not all. These loans have a tranche structure, and Toast acts as the most subordinate stakeholder. If a loan goes bad and the restaurant defaults (or is no longer considered a prime borrow), Toast is required to purchase the loan back from the bank. This arrangement holds for 15% of all loans originated in a particular quarter.

Toast originated $1 Billion in loans in 2024 - this structure means that in a wash-out type scenario, Toast would be on the hook for the first $150 million in losses.

In 2024, of the $1 billion in loan originations, Toast collected $135 million in fees. They also purchased back $45 million in bad loans (representing a 5% default rate). This netted $90 million dollars of accretive cash flow.

In general, I view Toast Capital as a dark cloud hanging over what is otherwise a very strong business. Restaurants aren’t exactly known to be resilient. Not only is Toast leveraging their business further on the gyrations of this segment of the economy, they’re willingly subjecting themselves to the worst performers.

Toast claims to be improving their underwriting, but this is definitely something to keep an eye on. Toast Capital doesn’t currently have the capacity to impair the entire business as a whole just yet, but this is definitely something that I’ll keep an eye on going forward.

Financial Technology Solutions: Top-Line

Note that these numbers don’t include write-offs associated with Toast Capital.

Hardware & Professional Services

When a store signs on with Toast, they need all the equipment - terminals, handhelds, service kiosks, etc. In addition, Toast provides customer support to help get everything up and running for the customer.

This is generally a one-time transaction where Toast partially subsidizes the setup costs to the restaurants - Toast incurs a loss on this portion of the business. They have historically cited a ~14 month (targeted) payback period.

The best way to think about this is that it takes $13,250 dollars to set up a new location on the Toast network (using 2024 numbers). The customer contributes $7,180, leaving Toast with a net loss of $6,070 per store.

You can multiply the unit economics by the number of stores added each year to reach the gross numbers.

Valuation

Figure 7 highlights the high-level valuation assumptions that I’ve made. In general, I think it’s a safe bet that subscription revenues and volume take rates have more-or-less leveled off. Toast did try to raise their transaction fees in early 2025, and had to immediately walk it back. So I think they’ve hit their relative ceiling in pricing power for the time being.

I’m also explicitly building in some level of churn. This is actually probably already implicitly captured in hardware costs, but I don’t see any harm in building in a modest impact…even if we’re now double counting it.

I am also forecasting relatively high opex growth at 5% per-year increases.

The forecast ends in 2031. I assume that their steady state growth market penetration is around 30% at just under 300k locations. Figure 8 shows the full valuation (apologies for the tiny font).

Using the assumptions above, I estimate a fair value of around $30 per share.

I think this actually offers an interesting value opportunity. The analysis that I’ve presented offers a modest and reasonable outlook for location and revenue growth. But there is still optionality in that management has set a target for half a million locations.

Over the long term, we believe these new TAMs have the potential to surpass our core business. And enable us to scale from 156,000 locations today to 500,000 locations and beyond.

~Aman Narang (CEO) 2025, Q3 Earnings Call

This largely hinges on market penetration into new verticals - international restaurants and grocery.

In a way, at today’s market value ($33 per share), we are buying the core business and are getting the potential expansion for free. In fact, if we extrapolate our growth assumptions to the late 2030s, reaching 500k total locations, our fair value for today would be in the mid $50 per share range.

Other Notes

When I look at Toast, I sort of see “Shopify for the physical world”…or at least for restaurants2. What makes Toast’s model inferior is that it requires a lot of upfront investment from the company for a business model that has a pretty high failure rate (something like 50% of restaurants fail within the first five years). Meanwhile, Shopify mostly offers templated merchandise websites and POS add-ons. I’m being a little unfair to Shopify, but the broad point is important. The barrier to entry for Shopify’s customers is much lower. Opening and operating a restaurant is hard. Spinning up a website that sells t-shirts is easy. Toast will always be at a disadvantage just due to those business dynamics.

Even still. Restaurants are everywhere. And Toast is solving real pain points for these businesses. That shows up in a very tangible way in their subscription-based ARPU numbers: Toast captures approximately $6,000 in annual subscription based revenue per customer compared to $600 for the average Shopify customer. These don’t even include payment processing.

Also, considering that the failure rate is so high for restaurants, we can’t really think of return on invested capital in the same way we might think about other software businesses. The numbers still bear out positive present value - the payback period is just over a year for new restaurant setup costs, so every subscription dollar after the first year is effectively “free and clear”. But we should expect some churn in the business.

It’s not all bad, though. Investing in Toast is almost a pure-play way to bet on / hedge against inflation. Everything from wages to occupancy costs to food costs and beyond will ultimately drive Gross Payment Volume (GPV), which is a big contributor to Toast’s gross profits. As long as those things don’t permanently impair the restaurant sector, Toast should benefit.

In addition, Toast seems to be breaking into more enterprise level customers. This is a good thing as these locations should have longer lifespans on average. One thing we should be aware of is that ARPU may come down as they bring in larger players. This isn’t a bad thing, and I want to make sure I highlight this here. Even if Applebee’s pays Toast 70 cents on the dollar for subscription services, it still works out in Toasts favor if the life of an Applebee’s is twice as long as an SMB. So we shouldn’t necessarily impair our valuation if ARPU starts marching backwards a tad…just something to keep in mind.

Risks

The restaurant industry is probably the most fragile part of the economy. In a recession, eating out is probably the first budget item to get cut for most households.

A wash out in the restaurant industry could result in a “reset” in customer count, which would mean that Toast will have to spend a lot of resources in re-acquisition efforts during the recovery.

This would also mean that long-run market penetration could be higher, though, as it removes any inertial friction for existing shops - if Clover works fine, why switch to Toast…even if Toast is marginally better (this dynamic goes away)

Toast Capital: Toast is the most subordinate tranche in the credit structure. Toast has to eat losses first before their partnered banks take on defaults. This is particularly dangerous as restaurants are pretty fragile businesses to begin with. Toast’s current exposure is about $150 million, so this part of the business isn’t big enough to sink the company just yet. But it is something to keep an eye on.

First, the revenue and profit numbers are obfuscated because they’re lumped in with Financial Technology Services (FTS). They do give additional information during the earnings conference calls - you can read them in the Prepared Remarks for each quarter. But in addition, losses due to defaults are captured elsewhere in the financial statements - as far as I can tell, they’re captured in the G&A line item on the Income Statement.

I’m aware that Shopify supports physical locations