CAVA: Valuation

Lightning Round

I’m on the hunt for my next company to follow. I ate at CAVA earlier this week, so figured this was the perfect stock to dive into next.

Let me know in the comments if there are any other companies that you’d like to see me cover.

To explore more companies that I’ve covered, check out the full Corporate Valuation Catalog

Business Overview

CAVA Group, Inc. is a fast-casual restaurant chain specializing in authentic Mediterranean cuisine through a customizable menu of bowls and pitas. Think Chipotle, but for Mediterranean food.

They formerly owned and operated Zoe’s Kitchen restaurants. As of the end of 2023, CAVA completed the transition, converting all Zoe’s Kitchens to their flagship CAVA chain.

Valuation Drivers

For a restaurant chain like CAVA, there are really only two avenues to grow earnings.

One option is to make (and keep) more money per store. This could come in the form of raising prices, lowering costs, selling more items per customer, attracting more customers per location, etc.

The other option is to simply open more stores and rely on the unit economics and return on invested capital rates to create shareholder value.

I will mostly focus on the latter as that is will be CAVA’s primary driver for the foreseeable future.

CAVA currently operates 415 locations as of the end of Q3, 2025. They have aspirations to reach more than 1,000 stores by the end of 2032:

“We are in the early stages of fulfilling our total restaurant potential, and we believe there is opportunity for more than 1,000 CAVA restaurants in the United States by 2032”

~ Q3, 2025 10-Q

Unit Economics

Store level unit economics basically break down as follows:

AUV (average unit volume) represents the total per-store revenue seen in a given year. Occupancy is primarily tied to operating leases. The rest of the components are relatively self explanatory. I’ve added G&A for the purposes of this analysis - CAVA reports G&A (General & Administrative expenses - i.e., executive and HR salaries) at the corporate level, but it seems that there is some level of overhead that scales with the number of stores in the portfolio, indicating that G&A isn’t a truly fixed cost.

As of 2025, AUV has reached roughly $2.9 million per store. The EBITDA margin (before including G&A) has hovered between 24.5% and 25%. G&A per store is currently around $0.32 million.

This means store-level EBITDA lands around $410,000 per year after accounting for G&A expenses.

Invested Capital & ROIC

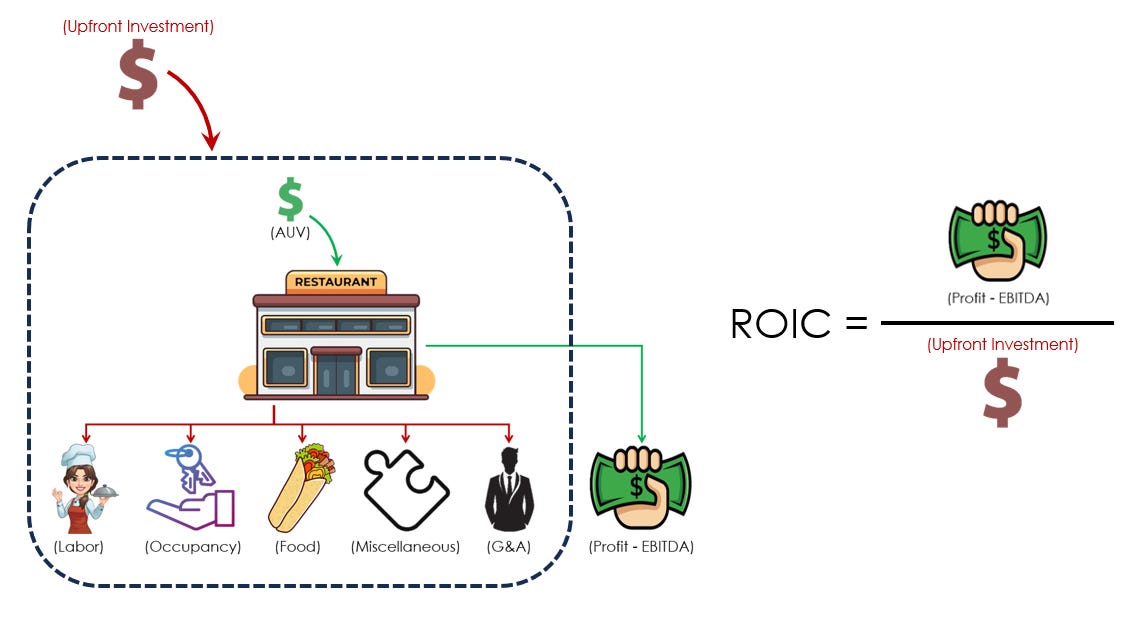

In order to open up a new store, there are two upfront costs: Capex & Pre-Opening Costs.

Capex includes outfitting the restaurant with all the equipment and building improvements. Pre-opening costs include all non-capex costs that are incurred prior to opening the store. These include things like recruiting, training, salaries paid prior to opening, etc.

For new store openings, the numbers work out to:

Capex: $2.5 million per store

Pre-opening: $0.30 million per store

Total Invested Capital: $2.8 million per store

ROIIC: 14.6% ($0.410 million ÷ $2.8 million).

This is a good sign, and implies that opening new stores is a worthy endeavor vs the alternative of returning cash to shareholders.

Valuation

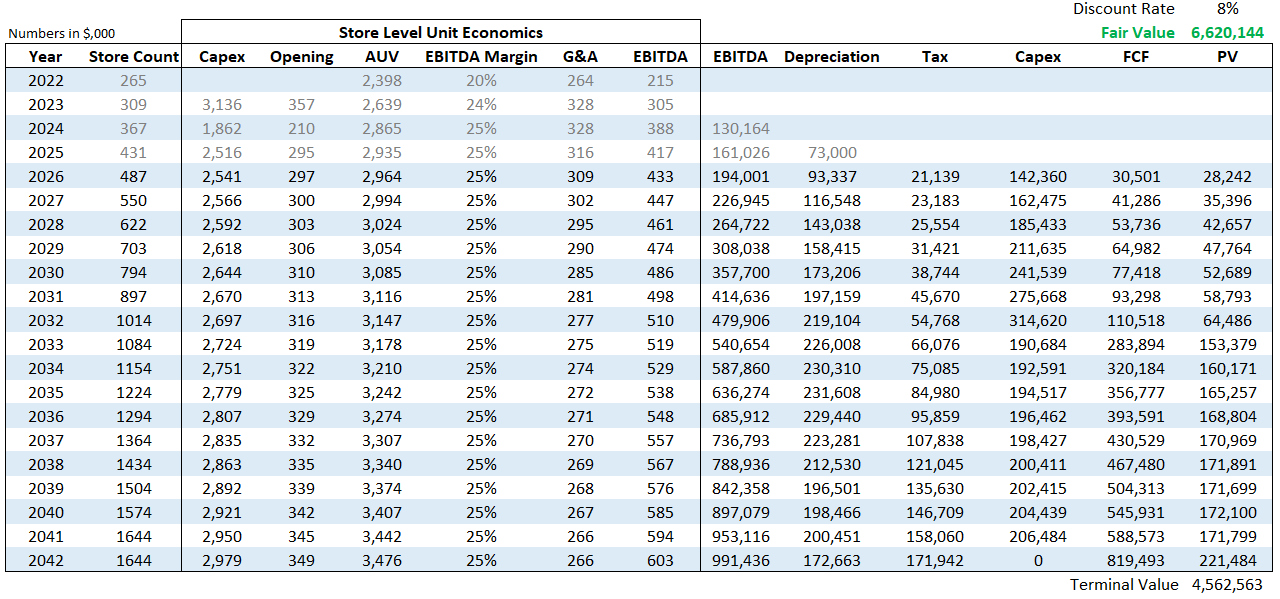

Here are the high level assumptions that I’ll use:

Achieve 1,000 stores by 2032 (roughly 13% growth rate). Then assume new store growth rate slows, growing to 1,600 stores in the proceeding 10 years.

Store level EBITDA margins (excluding G&A and opening costs) remain at 25%

AUV, Capex, Opening Costs grow at a rate slightly below inflation driven by growth into smaller markets.

G&A sees efficiency gains as more stores are added

Discount rate: 8%

No debt and no preferred shares make valuation analysis pretty clean

Using these assumptions, fair value is around $6.6 billion (about 18% below the current share price). See table below.

Obviously this will be sensitive to the assumptions that I’ve made above. If we were to assume that AUV grows closer to inflation or that margins expand a bit, I can get to about a $10 billion valuation.

So between $6B & $10B seems like a perfectly fine range to assume. Given today’s valuation just above $8B, I would say the stock is about fairly valued.

If we were to assume that they continue to accelerate store count growth to >3,000 stores by 2042 (doubling the current assumption), the valuation climbs to about $12B. This makes sense given that ROIC is greater than the cost of equity (or discount rate). The cash flows are better left with the management team to grow internally. Albeit, they will eventually reach a point of diminishing returns for new store openings. But growth to 3,000 stores isn’t an outlandish assumption - Chipotle has 4,000 locations. However, I’m not sure if it’s safe to bet on Mediterranean food becoming as ubiquitous as a burrito.

Just as a sanity check. CAVA is about where Chipotle was in 2006 with around 500 locations. Chipotle, today, has 4,000 locations and carries a $52B price tag. If CAVA were to follow in Chipotle’s footsteps, and grow to $52B in the next 20 years, that works out to just under 10% forward returns. That further reinforces the finding that CAVA doesn’t currently offer a ton of compelling value.

Note that this DCF is a very rough attempt (lightning round). If I had gotten a valuation that looked more compelling, I would have sharpened my pencil a bit. So take these numbers with a massive grain of salt. It will be interesting to track some of the high level numbers, though, and if my conversion to free cash flows is in the ballpark. If we see acceleration in store counts, AUV, growing margins, or if FCF starts to outpace my very crude forecast, I might circle back on this one.

Buy, Sell, Hold?

I think CAVA is about fairly valued, and my forecast is market-perform - long-term expected returns are 8% ± 2%.

The food is good. I don’t know anything about management, but if you’re a believer, this could fall into the “great company at a fair price” bucket just due to the unit economics, alone. If we get any indication that they have intentions on accelerating expansion, we could see a 50% rerating upward from here.

To explore more companies that I’ve covered, check out the full Corporate Valuation Catalog

Sharp analysis on the unit economics breakdown. The ROIC at 14.6% is solid but the real question is whether they can maintain those margins as they push into seconday markets where real estate costs vary widely. I tried CAVA once and the customization model works well, but dunno if mediteranean will have the same mass appeal as Mexican food in smaller cities. The Chipotle comparison is useful but might be overly optimisitc since burritos have decades of cultural adoption here.