Joby: Addressable Market

Air Taxi Operations

Joby Aviation - Table of Contents

Summary

The goal with this study is to get a feel for the total addressable market and how much of it Joby can fill.

At a production rate of 500 aircraft per year, the global Joby fleet would be sustained at roughly 5,000 total aircraft (depending on usage, etc). This fleet size can maintain a passenger volume of 800,000 passengers per day.

To put this into perspective, this level of volume would represent any of the following:

0.5% of total daily rideshare (Uber & Lyft) trips

7% of global trips to or from the airport

0.6% of the available global developed market assuming daily usage

In addition, to support this level of available seats, the global network would require a minimum of 2,000 landing pads.

All assumptions are presented below.

If you’re enjoying this type of content and would like to see more of it, please consider liking this post. Thanks!

Vision of Scale: Passenger Volume

A good place to start is to estimate just how many passengers an eVTOL operation can support. Once we have passenger volume, we can then try to determine if there’s actually a market that will fill it.

Passenger volume (n_PAX) is a function of fleet size (n_fleet), flight volume (n_flt) per period, and the number of passengers per flight (n_ppf).

I’ve previously shown that the fleet size for the Ohio plant build rate of 500 A/C per year is roughly 5,000 units.

And the number of flights, dependent on trip distance, might average around 40 flights per day (assuming the average trip distance is 25 miles - an assumption I’ve pulled from a Joby pitch deck).

Pulling these together, the average (available) daily seat-volume is 800,000 (5,000 vehicles x 40 flights per day x 4 seats per flight). This means that Joby, at scale, can support “up to” 800,000 passengers per day. Not every flight will be full, and the actual numbers will be dependent on typical route distance and aircraft up-time, but this is the maximum passenger volume they could potentially support with a fleet supported by an Ohio sized production facility.

Daily Available Passenger Volume (at scale): 800,000 passengers

The figure above shows Joby’s ramp once their Ohio facility ramps to 500 aircraft per year. In year 1, Joby will have 500 aircraft available and can serve 80k passengers per day. By year 10, their fleet will grow to 5,000 aircraft and will have the ability to serve up to 800k passengers per day. After year 10, their fleet size will quit growing unless they expand their aircraft production rate.

Total Addressable Market

Determining the populace that can afford to use aircraft on a regular basis is going to be more art than science I think.

Current Rideshare Market

A decent place to start is to look at the current rideshare market. Uber and Lyft currently serve just under 40 million trips per day. At scale, Joby’s fleet could offer 200k flight per day.

On a per-trip basis, Joby would need to capture 0.5% of the total rideshare market (1 in every 200 trips needs to become a Joby ride). The validity of this ratio scales with the unit economics of the competing modes of transport. As Joby rides get cheaper, it’s reasonable to assume that air-taxis can eat a larger percentage of the rideshare market.

Developed Market

Alternatively, we might look at the global addressable market as a whole.

Developed markets include countries like the U.S., Canada, Western Europe, Japan & South Korea, and etc. An estimation for this cohort is around 1.2 billion global residents.

Not everyone in these nations will be able to afford these on a regular basis (at least not at the price points Joby wants to start at). If we consider the top decile of residents as the primary users of these air-taxi services, that whittles the addressable market down to 120 million.

Using this number along with our estimate of 800k passengers served daily, we’d need 0.6% of this addressable partition to use air-taxis, daily.

This would imply 1 out of every 150 people inside this partition (developed market, top decile) use these per day.

Dense Cities

Globally, there are 600+ cities with a population of 1 million or more people.

The following table shows the 50 largest markets in the world. As a quick sanity check, here are some back of napkin assumptions:

One air-taxi per 50k residents (NYC has 19 million residents; I assume that 380 air-taxis can service the city - this would mean 60,000+ available seats fly per day in NYC). This number signifies that there is 1 available seat for every 300 residents per day.

I adjust down this number based on median income of the city (Tokyo could potentially support 740 air taxis based on the population ratio calculated in Step 1. But since the city is ‘poorer’, on average, I’ll adjust down by a ratio of Tokyo income to NYC income - 740 potential taxis x $40k / $82k = 352 air taxis)

Note that there’s nothing inherently correct about these assumptions. Things like income and wealth distributions might also need to be considered. In addition, operating costs won’t be uniform across regions. At any rate, this is a decent place to start for a rough estimate of demand.

In total, these 50-ish markets could potentially support 12k aircraft. Adjusted for income, this falls to 3,400 air-taxis needed to service the largest markets. This lines up well with the fleet size.

Again, I have no basis to show that these assumptions are correct. However, this would be wildly optimistic compared to Blade’s current operations. Blade currently serves 50,000 passengers PER YEAR, globally. The assumptions presented above suggest operations will surpass that number in New York City, alone, PER DAY.

Total global numbers suggest a nearly 1,000-fold increase in passenger volume compared to Blade’s current operations.

Airport Ferrying

One of the first target markets is to act as an extension for air carriers (i.e., Delta, Virgin Atlantic, etc). This makes sense because transit to airports is often a pain and in cities like NYC, Joby’s service would offer a massive time saver. They also offer a marginal cost increase over airfare - a $100 Joby ticket doesn’t seem so bad after you’ve just booked a $1500 plane ticket (although, average airline ticket prices are much lower these days).

In 2024, an average of 2.5 million passengers passed through TSA checkpoints per day.

Europe’s passenger volume is roughly 3 million per day.

These, combined, represent 11 million total trips to-and-from the airport on a daily basis.

To fill out the total available air-taxi volume of 800k daily passengers, approximately 7% of these trips would need to involve an air-taxi ferry.

It doesn’t seem that there’s enough volume here to meet all the available seats, but could certainly fill a good chunk of it.

Helipad Infrastructure

Once an aircraft lands on a helipad, I estimate that a minimum of 8 minutes is needed to turnover the aircraft before taking off again. The A/C turnover process would involve unloading arriving passenger, loading departing passengers, battery charging, etc.

This means that there is a finite number of aircraft and passengers that can be serviced by a single pad. Given a 15 hour daily operation window, and assuming an 8 minute turnover period, only 112 flights can be serviced by a single helipad per day. This means that only 450 available seats take off from one helipad per day. Which, in turn, means that close to 2,000 landing spots need to be available, globally. Many of these markets already represent dense areas with land shortages.

For example, if Joby wanted to ferry 10,000 passengers per day to JFK airport, they would need to dedicate 22 pads at both destinations.

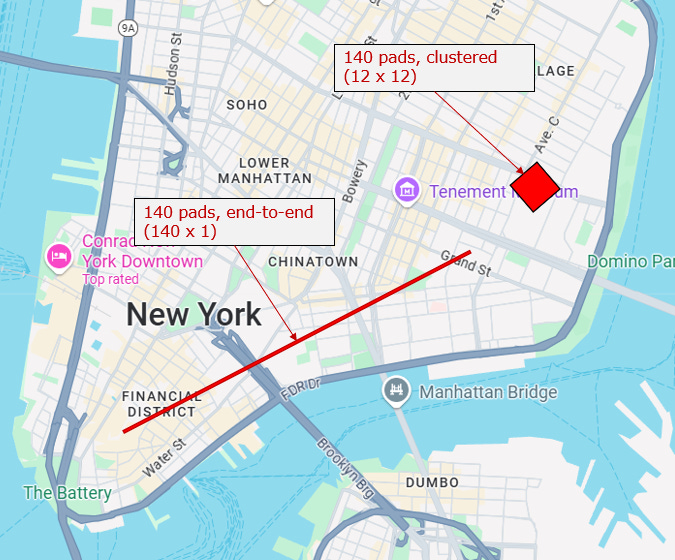

And to service the full 60,000+ daily passenger volume in NYC, 140 pads are needed. Note that at least half of these pads may not actually be in NYC proper. For instance, if all 60,000 passengers were ferrying to and from JFK (30,000 to the airport and 30,000 from the airport), you’d only need 70 pads at each location.

Just to give a sense of scale, a typical landing pad is roughly 60’x60’. The following image shows the area occupied by 140 landing pads.

This shows two different perspectives. The longer one shows the space needed if all the pads were lined up adjacent to each other (i.e., along the coast line). Note that neither of these account for any dead-space between the pads.

This actually seems very doable for an operational standpoint. 140 landing pads equal about 11 acres, which represents 0.005% of NYC’s total area. I’m not sure where landing pads will exactly fit in, and where eVTOL operators will find space, but these numbers don’t tell me it’s outright impossible.

There are some tricks they can try to cut down on the turnover time on the NYC side.

For one, they could charge the battery only at the JFK site where land is more abundant. This would reduce the number of landing pads needed to service the passenger volume.

In addition, vertiports may have loading and unloading areas. In this case, a Joby could land and taxi away from the landing zone, taking care of the turnover procedure out of the way of more inbound aircraft.

But there’s still a lower bound to turnover times, and unless you intend to have passengers sprinting to and from the aircraft, it’s going to be on the order of several minutes at best. And really, my estimates may already be on the aggressive side as true turnover time probably begins sometime during aircraft approach as the pad will be required to be empty for some period of time before the next A/C lands.

There are also some interesting mechanics involving the number of aircraft a landing pad “pair” can handle.

Consider the Manhattan to JFK route. The trip takes 8 minutes, and the expected turnover time is 8 minutes. This means that as one aircraft is landing, an aircraft can take off at the opposite end of the route. If the second aircraft were to depart any time before that, it would reach it’s destination while the first aircraft was still occupying the landing zone.

For that particular route (Manhattan to JFK), only 4 total aircraft can utilize a landing pad pair.

Figure 1 shows the example of a trip time that’s doubled to 16 minutes. Here, there would be an aircraft at the midway point as the one ahead of it is landing and the one behind is taking off (8 minute spacing). 6 aircraft can service this particular route.

This doesn’t really impact the unit economics or the passenger throughput numbers as the upper bound for passenger throughput is primarily a function of available landing pads and turnover time. But it’s worth noting.

There actually may be an upside to this relationship - it won’t take a massive fleet to capture economies of scale in terms of spreading out heliport fixed costs. All it takes is a small handful of aircraft to keep a pair of helipads fully booked.

Ticket Prices

Just to quickly touch on ticket prices (I’ve already covered that, in detail, in the unit economics study). There’s going to be a pretty clear relationship between ticket prices and demand.

In New York, the median salary is $82,000. At Uber Black or Blade prices, about $195 per seat for a one-way trip, if the median person wanted to take one Joby trip per week, their total spend would come out to be a meaningful 12% of their income. That cuts the NYC market by more than half right off the bat.

And that’s in the richest city in the world. To really see deep market penetration, globally, we’d need to see ticket prices come down substantially. See the Unit Economics article for more information on pricing and cost savings.

Final Remarks & Commentary

Keep reading with a 7-day free trial

Subscribe to Risk Premium: Research to keep reading this post and get 7 days of free access to the full post archives.